Homeownership brings with it a valuable asset beyond the comfort of having a place to call your own – home equity. Today, homeowners collectively hold trillions in equity, presenting an opportunity to leverage these funds for various financial opportunities. Whether it’s funding home renovations, consolidating debt, making financial investments, or covering life events, your home equity can be a valuable resource to leverage for your benefit. In this blog, we’ll discuss the many options you have available to access your equity!

Loan Products to Access Your Equity:

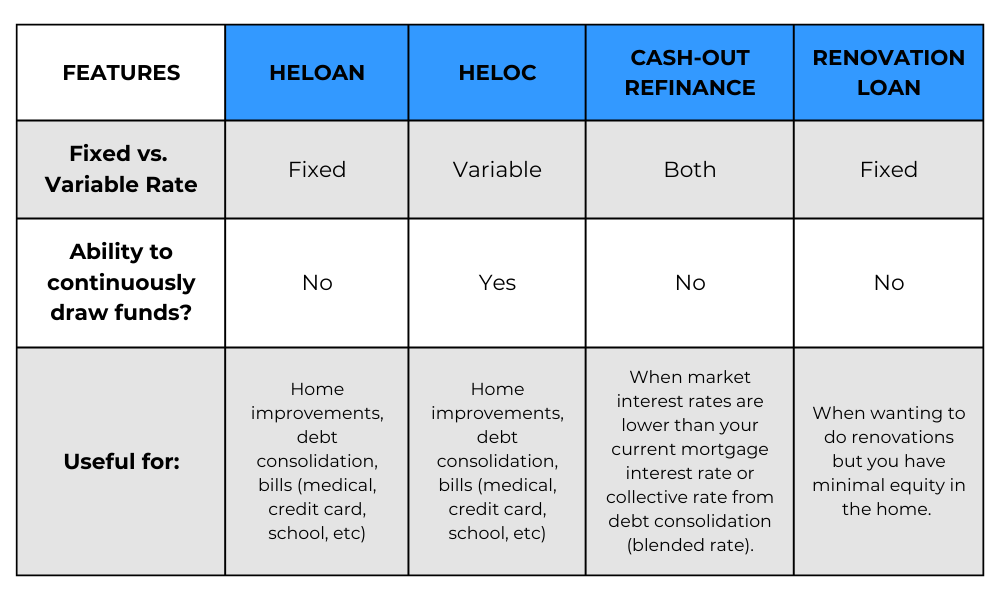

- Home Equity Loan (HELOAN):

- A fixed-rate loan offering a lump sum payment.Ideal for those with a clear vision of their financial needs.

- Consistent monthly payments, providing stability.

- Home Equity Line of Credit (HELOC):

- A flexible credit line secured by your home’s equity.Allows for periodic access to funds when needed.

- Adjustable interest rates, providing flexibility but requiring careful financial planning.

- Cash-out Refinance:

- Replace your existing mortgage with a new one, withdrawing excess funds.Fixed monthly payments and potential for lower interest rates.

- Suitable for those looking to streamline mortgage payments and access substantial funds.

Renovation Loan Highlights:

- Borrowing Based on Expected Home Value:

- Allows you to access funds based on the anticipated post-renovation value of your home.

- A great solution for those seeking additional funds for renovation but lacking sufficient equity in the home.

- Building an Accessory Dwelling Unit (ADU):

- Utilize renovation loans to finance the construction of an ADU.

- Enhances the property’s value and provides potential rental income.

- Purchasing a Property That Needs Upgrades:

- The renovation loan product can also be used on a home purchase.

- The downpayment can be as little as 3% with a HomeStyle renovation loan.

What Loan Product Is Best:

When deciding to access your home equity, it’s crucial to consider various factors that can significantly influence which loan product is best for your situation. Two key considerations are the amount of debt you are borrowing and the interest rate of the loan product. As your loan advisor, we help provide a blended interest rate calculation that takes into account the interest rates associated with your existing mortgage and the new loan you’re considering, weighted by the loan amounts. This helps you assess the potential impact of blended interest rates on your financial situation, providing clarity on the short-term and long-term implications of each loan option.

As you explore possibilities with your home equity, remember that your homeownership is not just a place to live but a gateway to financial opportunities. Now is the time to leverage your home equity and unlock its potential. Our dedicated team is here to guide you through the process, offering insights, expertise, and personalized solutions. Whether you’re considering a HELOAN, HELOC, or renovation loans, our goal is to empower you to make informed decisions as a homeowner.